Home Equity Loans vs. Equity Loans: Recognizing the Differences

Home Equity Loans vs. Equity Loans: Recognizing the Differences

Blog Article

Unlock Financial Possibilities With a Home Equity Loan

Homeownership offers a realm of financial chances past simply supplying a roof covering over one's head. Take into consideration the opportunities that lie within making use of a home equity finance. This monetary device provides a way to take advantage of the equity you've integrated in your home for different functions. From making home improvements to combining financial debt, the possible advantages are various. As we check out the mechanics and advantages of home equity loans, you may find a path to unlocking surprise economic capacity that can reshape your monetary landscape.

Benefits of Home Equity Lendings

Home Equity Finances offer property owners a practical and versatile financial solution for leveraging the equity in their homes. Among the key benefits of a Home Equity Funding is the capacity to access a large amount of cash upfront, which can be utilized for different purposes such as home improvements, financial debt combination, or financing major expenditures like education or medical expenses. Equity Loan. In Addition, Home Equity Fundings commonly include lower rate of interest compared to various other kinds of car loans, making them an economical loaning alternative for home owners

Another advantage of Home Equity Loans is the prospective tax advantages they supply. In numerous cases, the rate of interest paid on a Home Equity Financing is tax-deductible, supplying house owners with an opportunity to conserve money on their tax obligations. Furthermore, Home Equity Lendings typically have much longer repayment terms than various other sorts of financings, enabling borrowers to expand their settlements over time and make managing their funds a lot more convenient. In general, the benefits of Home Equity Loans make them a beneficial device for homeowners looking to open the monetary capacity of their homes.

Just How Home Equity Loans Work

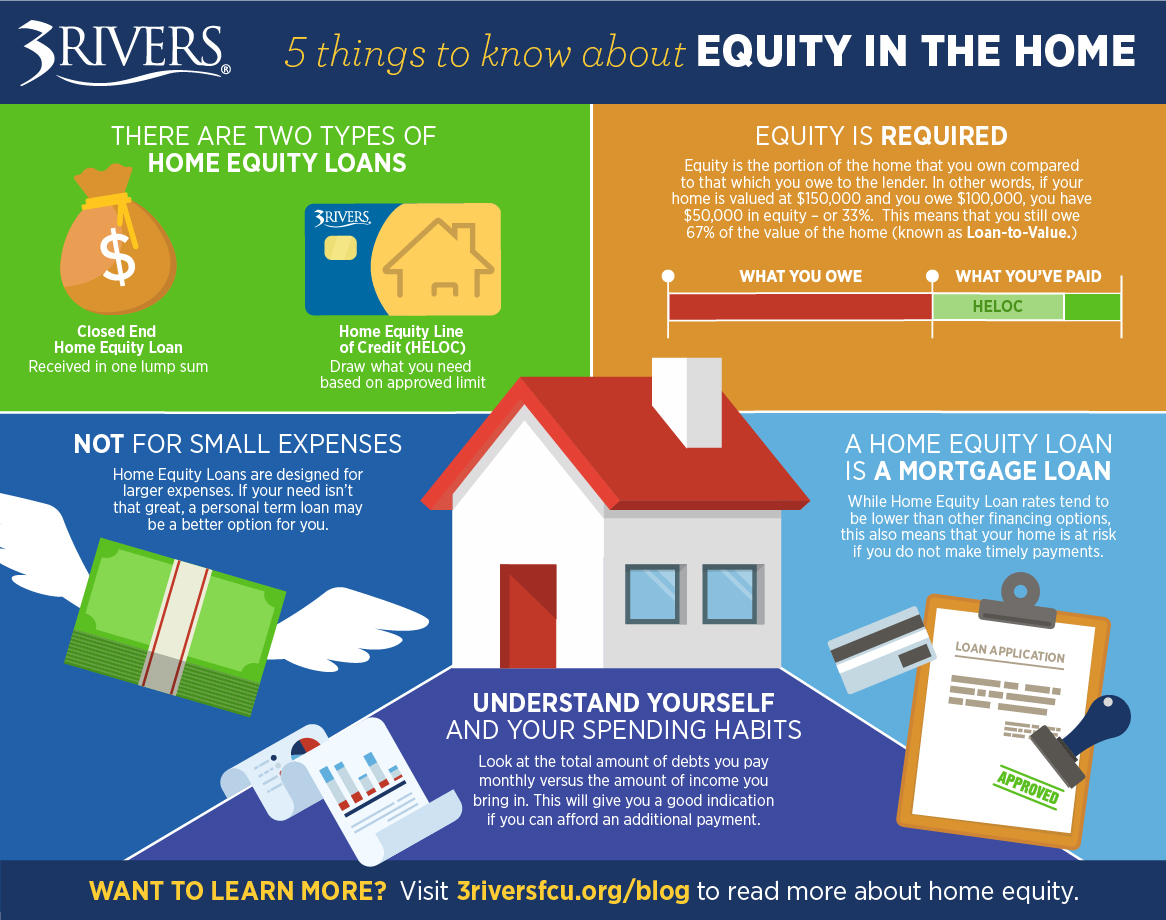

Offered the significant benefits and benefits laid out concerning leveraging the equity in one's home, understanding the mechanics of exactly how equity finances operate becomes essential for home owners seeking to make enlightened monetary decisions. Home equity financings are a kind of financing in which the consumer utilizes the equity in their home as security. Equity is the distinction between the assessed worth of the home and the impressive mortgage balance.

When a homeowner requests a home equity funding, the lending institution assesses the worth of the property and the amount of equity the debtor has. Alpine Credits copyright. Based upon this assessment, the loan provider establishes the maximum finance amount that can be extended. Home equity loans normally have fixed rate of interest and are disbursed in one lump amount. Debtors after that pay back the car loan over a set term, making normal month-to-month settlements. The passion paid on a home equity lending might be tax-deductible, making it an eye-catching alternative for home owners seeking to fund major costs or combine high-interest financial obligation. Recognizing the terms, payment framework, and possible tax benefits of home equity lendings is essential for house owners considering this monetary option.

Using Home Equity for Renovations

Making use of the equity in one's home for renovations can be a critical financial move that not only improves the home but additionally includes worth to the home. Home equity car loans use property owners the chance to gain access to funds based on the value of their residential property past the superior home mortgage equilibrium. When considering improvements, leveraging home equity can offer a cost-efficient option compared to various other kinds of loaning, as these finances usually offer reduced rate of interest as a result of the security offered by the residential property.

Combining Debt With Home Equity

When considering financial approaches, leveraging home equity to consolidate financial debt can be a prudent alternative for individuals looking for to enhance their repayment responsibilities. Combining financial debt with home equity entails getting a finance using the equity developed in your home as collateral. This technique permits borrowers to combine numerous debts, such as charge card balances or individual lendings, into one single repayment. By doing so, people may gain from reduced rates of interest offered on home equity fundings compared to various other kinds of financial obligation, possibly lowering general interest costs.

It is crucial to very carefully consider the threats involved, as failure to settle a home equity lending might lead to the loss of your home through foreclosure. Consulting with a financial consultant can assist identify if combining financial debt with home equity is the right option for your economic circumstance.

Tips for Safeguarding a Home Equity Loan

Protecting a home equity finance requires precise prep work and a detailed understanding of the lender's demands and analysis criteria. Prior to looking for a home equity lending, it is necessary to assess your financial situation, including your credit rating, existing financial debt commitments, and the amount of equity you have in your home. Lenders usually try to find a credit history of 620 or higher, a manageable debt-to-income proportion, and at the very least 15-20% equity in your home. To raise your possibilities of authorization, think about boosting your credit rating, paying for existing financial obligations, and properly determining the equity in your home.

Along with economic readiness, it is important to shop around and compare deals from different that site lending institutions. Look for affordable rate of interest, favorable lending terms, and low costs. Be prepared to provide documents such as proof of earnings, income tax return, and residential property evaluations throughout the application procedure. By demonstrating financial duty and a clear understanding of the funding terms, you can enhance your chances of protecting a home equity loan that lines up with your goals and requirements.

Conclusion

In conclusion, home equity car loans provide a variety of benefits, including the ability to accessibility funds for remodellings, financial debt loan consolidation, and other financial demands. By leveraging the equity in your home, you can open new opportunities for handling your finances and accomplishing your goals. Home Equity Loan. Comprehending exactly how home equity fundings work and following best techniques for securing one can assist you make the many of this useful economic tool

Home equity finances are a kind of car loan in which the customer makes use of the equity in their home as security (Alpine Credits copyright). Consolidating financial obligation with home equity entails taking out a finance making use of the equity developed up in your home as security. Before using for a home equity car loan, it is vital to evaluate your monetary scenario, including your credit rating score, existing financial obligation commitments, and the quantity of equity you have in your home

Report this page